2024 Consumer Trends

Each year, Rain the Growth Agency distills information from research and trade publications to share trends that may impact media, marketing and advertising to help brands understand what resonates with consumers.

2024 U.S. Elections

According to Axios, the U.S. political ad market is projected to reach $16 billion in 2024, a 31.2% increase from the 2020 election. This could lead to increased competition for advertisers later in the year, particularly with national inventory.

From the sentiment side of things, this election could potentially be riddled with misinformation, hate speech, and extremism that is aiding the increasing polarization within the country. People are losing trust in the party system as each continues to become more disliked and leaning farther away from each resulting in shrinkage of common ground. Brands should look to find common ground between potentially polarized audiences through mediums like music and culture, even across generations.

Sporting Events Take Center Stage

Several key sporting events this year will impact media consumption habits, including:

Paris Olympics — NBC holds exclusive Olympics broadcasting rights through 2032.

- With the games in western Europe, viewership is expected to break records given friendlier time zone differences for American viewership.

- This will be the first time the summer games will be available entirely through streaming.

- 20-25% of total consumption expected through digital channels and Peacock.

- NBC predicting four times the streaming minutes for the Paris Olympics compared to the Tokyo Olympics.

- Brands are particularly interested in women athletes and NBCUniversal’s coverage of women’s sports, which will account for more than 50% of the network’s coverage.

Women’s Sports — Deloitte is forecasting that women’s sports could bring in $1 billion in revenue in 2024, up 300% since 2021.

- The Olympic Games will also be capitalizing on the rise, with NBCU’s coverage of women’s sports projected to account for more than 50% of the network’s coverage.

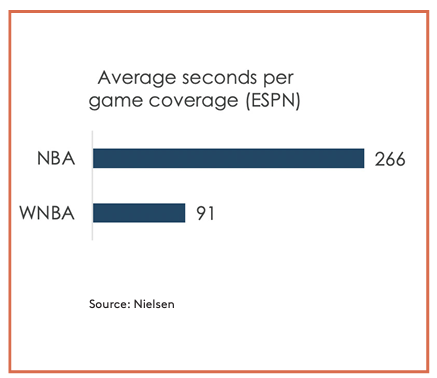

- Even given the increase in popularity and new major media investments into women’s sports, there is still a long road ahead.

- According to Nielsen, one in four Americans say there isn’t enough information in the media to keep up with women’s sports.

Consumer Outdoor and Lifestyle Trends

- Social meets fitness: From weight loss to fitness and training, social fitness wearables and apps are bringing people together sharing their fitness journey. Community-driven fitness continues to drive us out of COVID isolation.

- Recovery technology: Fitness fanatics are diving into the importance of recovery. From ice baths and saunas to massage guns, consumers are getting excited about the evolving world of recovery products.

- Return to outdoors: Post-pandemic, society is embracing more outdoor recreation activities to improve things like mental health and overall physical fitness.

- Pickleball mania: Over the past three years, pickleball has seen a growth of +158% in number of active players and is the fastest growing sport in the U.S. The sport offers low barrier for entry and accessible across all ages.

What is the Current Consumer Sentiment?

It’s important to understand the current consumer mindset, which can help advertisers better understand how to reach and message to their customers. We see this playing out in the following four areas:

- Future shock — According to WGSN, future shock is “a feeling of distress driven by rapidly accelerating change in society and technology.”

- Overstimulated — Isolation and changing work patterns and social habits have rapidly shifted how we use our senses to navigate the world. This dramatic decrease in attention span means media like short-form videos are here to stay. Sensory regulation will be something that consumers seek.

- Tragic optimism — An antidote to “toxic positivity”— this outlook focuses on being more realistic.

- Awe — the antidote to anxiety, consumers may seek daily “awe experiences” that can reduce depression, and lower stress and brain fog.

The Take Care Economy — What Consumers Want

So given the current consumer mindset and an increased focus on self-care, what do consumers want from brands and products?

Value and convenience

- Despite potential easing, prices remain high, driving value-driven shopping habits. Consumers will prioritize deals, discounts, and brands offering the most bang for their buck.

- Consumers seek seamless shopping experiences across channels, with options like buy online, pick up in-store (BOPIS) and same-day delivery being increasingly important.

Health and wellness

- Focus on mental, physical, and emotional well-being will continue, with personalized approaches and preventative measures gaining traction.

- Consumers will increasingly pay attention to ingredient lists, seeking out products with natural and sustainable ingredients and avoiding harmful additives.

- Growing demand for personalized dietary recommendations and food products tailored to individual needs.

- Zero-proof revolution: low-to-no alcohol market continues to boom after record-breaking 2023.

Tech and experience

- Consumers are intrigued but wary of generative AI’s potential, with responsible use and transparency being key concerns.

- Engaging video content in short formats will continue to dominate social media and influence brand awareness and engagement.

- Brands should create immersive and interactive shopping experiences to differentiate themselves and build customer loyalty.

Social and enivronmental responsibility

- Consumers will demand transparency about a brand’s ethical practices, including sourcing materials and labor conditions.

- Eco-friendly products and packaging will be increasingly sought after, with a focus on reducing waste and environmental impact.

- Brands that actively engage with and support their communities will resonate with consumers seeking positive social impact.

This article is featured in Media Impact Report No. 53. View the full report here.