Understanding the Relationship Between Linear and Streaming with MRI-Simmons Cord Evolution Study

The MRI-Simmons Cord Evolution study tracks the interaction between TV, video, OTT, and streaming apps. The study is fielded and released three times per year to understand the shifting demands of TV viewers.

Key features and capabilities include:

- In-depth view of the video landscape tied back to brand and psychographic data for media planning.

- Insight into not only what and how they are watching, but also the whys behind their viewing and subscription choices.

- Details on past, present, and future use of pay TV subscription services.

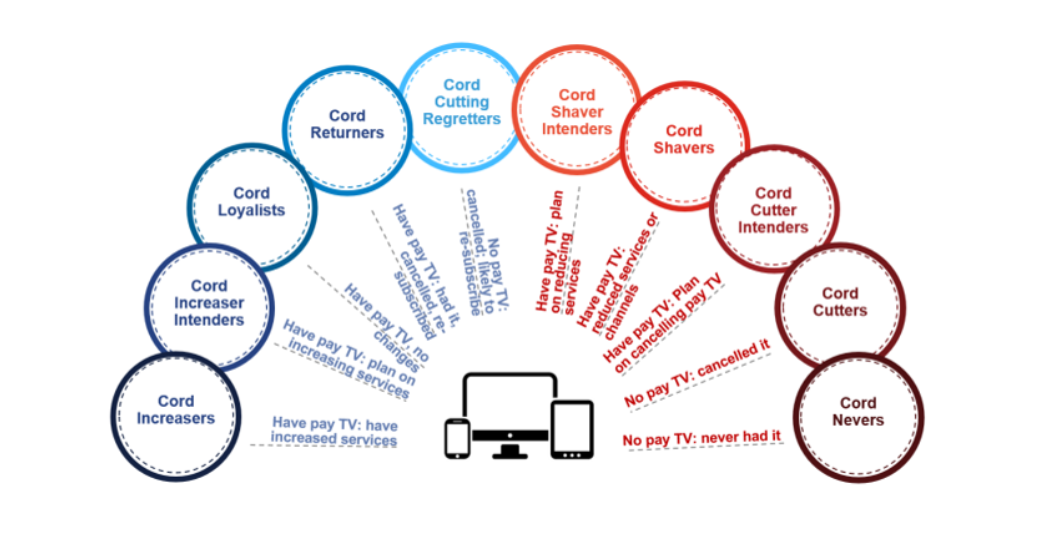

- Ten segments on the TV “cord spectrum,” and the ability to assess ongoing and accurate market sizing for each.

The most recent study (2024 March Cord Evolution) found that 64% of adults (164M) fall into the Cutting Back or No Pay-TV categories (Cord Shaved Intenders to Cord Nevers)

- 78.4M adults are Cord Cutters (31%)

- 58M are Cord Nevers (23%)

Despite this group being the largest collective group, Cord Loyalists make up the largest segment at 79.2M (31%), highlighting the balance necessary between traditional linear and streaming to reach audiences across TV screens.

Age distribution by cord segment skews younger as we progress into Cord Cutters and Cord Nevers

- 39% of A35-54 are Cord Cutters

- 49% of A25-34 are Cord Nevers

The largest segment of Cord Loyalists are made of A65+, a trend we continue to see with traditional linear TV viewership skewing older.

- 54% of A65+ are Cord Loyalties

The study also asks specific questions around FAST and ad-supported streaming services used. Overall, ad-supported streaming services have higher reach across all ages with YouTube having the highest potential across all age groups.

The Cord Evolution survey helps our clients understand the who, what, how, and why of today’s TV viewership trends. The study dives into the motivations and drivers of cord behavior and usage trends for over 180 streaming services and apps across the ten cord segments.

This article is featured in Media Impact Report No. 54. View the full report here.